Navigating 2023: Economic Trends and Insights for SME's

As we dive into 2023, it's important for small business owners to be aware of the developing trends that may impact their operations and risk mitigation strategies.

The state of play

- Despite inflation likely past it's peak in 2022, we expect it to hang around in 2023 with several implications for small business owners.

- Where business owners may have previously focused on sales and revenue targets, now is the time to double down on margins. If inflationary pressures are increasing your costs significantly, yet you are only prepared to raise prices marginally, you can quickly see who is going to take the hit. Many businesses don’t have sufficient reserves to ride this over the mid term after the last few years. The impacts of Cyclone Gabrielle are only going to add to inflationary pressures.

- Business costs will continue to rise in 2023, although it's probable this will be at a decreased rate before lifting at a more "normal" pace by next year. With this in mind, having a good understanding of your cashflow will position you well to make decisions that your business, and your bank account can sustain! No matter how good or bad the times are, cash is always king! One of the top business trends for 2023 is to prioritise profitability. Focus on the highest performing products and services, and reduce or eliminate wastage and overheads. This may lead to some tough decision making, But it will carry the business through in the long run. A key priority for businesses is to know your key numbers, and monitory these regularly. You can only manage what you measure!

- Small business owners will need to adjust to operating in a low-growth environment, making customer relationships and responding to their changing needs more important than ever.

- The OECD forecasts a worldwide inflation rate of 5.5% year-on-year by the fourth quarter of 2023, and small business owners will need to focus on their cash flow to remain profitable and cover their costs. There could be an increase in the amount of businesses that are operating at a low or negative growth rate in 2023. We know that business owners that invest time into their planning processes tend to be more successful over the long term. Working through a planning process now, as well as agreeing trigger points and contingency plans to address risks is a great start point to ensure the sustainability of your business.

The Job Market: talent retention and acquisition

The trend towards lower vacancy rates is expected to continue due to the slowdown in economic growth, however, unemployment rates are

likely to remain historically low, which may make it difficult for small business owners to find and keep workers. Using wage and non-wage

benefits and strategies will be crucial for keeping key staff and attracting new ones. Some businesses will benefit from greater

unemployment because there will be more people looking for work.

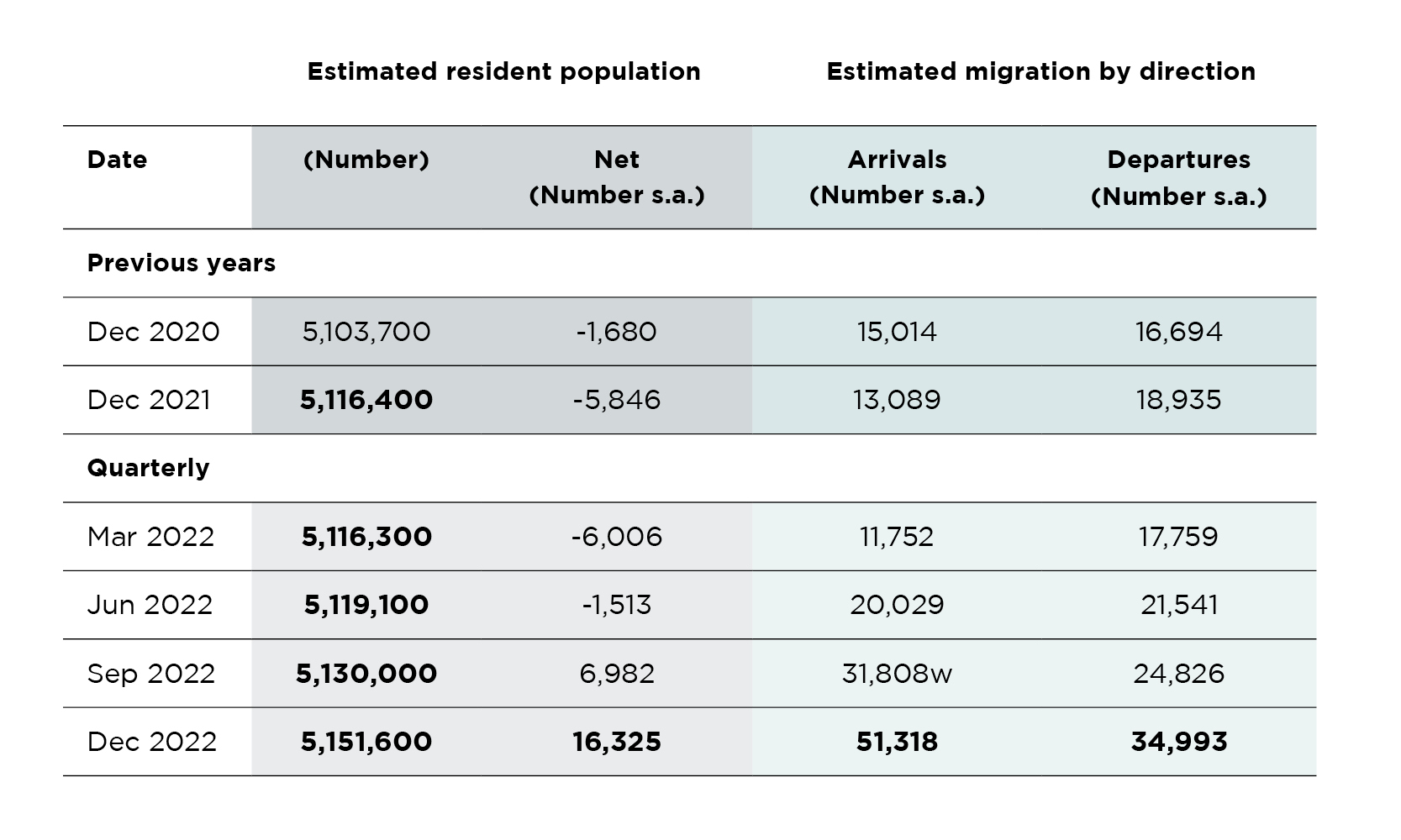

There was much hype of young talent leaving in droves for the greener pastures of Australia, or the rite of passage on an OE once boarder

restrictions were relaxed post COVID. The good news for employers is the tides are actually turning, with net migration in both September &

December 2022. This is largely being driven with arrivals from Asia and Europe (NZ

Hearld ).

While it is likely that higher unemployment will increase the number of people looking for work, undoubtedly business owners will be looking

for the immigration trends to continue. The key to taking advantage of a wider talent pool than has previously been available, is to be

organised! Having a clear business plan, knowing what roles you would like to fill, and what types of candidates you are looking for will

allow you to move quickly to secure good talent.

Source:

https://www.rbnz.govt.nz/statistics/series/economic-indicators/population-and-migration

Cyclone Gabriel: The impacts

We have all seen the devastating impact that recent weather events have had over the North Island, and our thoughts go out to everyone impacted. We would like to acknowledge the mountain that those affected must now face, the importance of solidarity, and also the wider, long term impact this will have on NZ.

The footage and images to date, may well just be the tip of the iceberg. The 3 regions of Northland, Tairawhiti and Hawkes Bay represent a significant bread basket, as food producers and suppliers for Manufacturing, Agriculture and Forestry industries. More than 29,000 self-employed and 11,600 small businesses operate in these regions alone. Auckland, Coromandel and the Waikato make up 30% of New Zealand's land mass, approximately half the population contributing to our nations GDP are impacted. Hon. Grant Robertson announced a $50 million support package for immediate relief, as well as a Cyclone recovery taskforce and related ministerial role, similar to what we saw following the Christchurch Earthquake. The impacts of this event are going to be felt for months and years, not days and weeks. With the impacts likely to be felt profoundly and at a wide scale, it is great to see Xero has made the Xero Assistance Program available to all small businesses in the North Island until 31st March 2022. If you would like more information click here.

Cyclone Gabrielle is yet another brutal reminder of the reality of climate change. It is a significant challenge we face, not simply a

topic of discussion at fancy conferences that world leaders jet in for. The insurance council records make for sobering reading. No less

than 10 significant weather events were recorded in 2022 alone, with the costs of these in the 100’s of millions. If you are wondering when

the time to start thinking about sustainability is, the answer is NOW. This is a theme the team at Connacc are passionate about, and would

welcome the chance to have a discussion with you on how your business can start on the journey.

Summary

Overall, 2023 will present challenges for small business owners, but with the right focus and strategy, they can thrive. Successful small business owners will focus on keeping on top of cash flow, responding to their customers and on staff retention strategies in 2023. As mentioned, having a clear plan, key trigger points and milestones identified, regular monitoring and review will enable business the agility to respond well to the conditions, and opportunities as they arise. As always, our team at Connected Accountants are here to provide guidance and support to help you achieve your goals.

Leave a Comment